Xero is one of the world’s leading cloud-based accounting platforms, designed to help small and medium-sized businesses manage their finances with ease, accuracy, and real-time visibility. Whether you are a freelancer, startup founder, or an established business owner, Xero offers a powerful suite of tools that simplify bookkeeping, automate daily tasks, and improve financial decision-making. This article explores what Xero is, how it works, and why thousands of businesses choose it as their primary accounting solution.

What Is Xero?

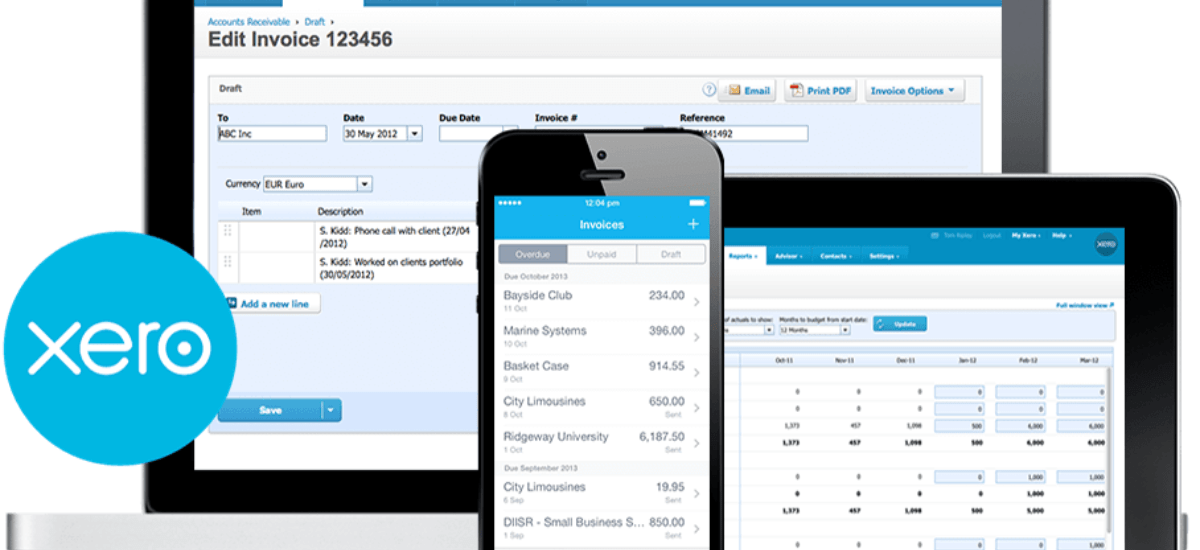

Xero is an online accounting software that enables businesses to handle invoices, bank reconciliation, payroll, cash flow reporting, inventory, and tax-related tasks—all from a cloud-based dashboard. Unlike traditional accounting software that requires installation, Xero operates entirely online, meaning users can access financial data anytime, anywhere, from any device. Its intuitive design and automation features make it especially valuable for business owners who want to reduce manual tasks and focus more on growth.

Key Features of Xero

1. Smart Invoicing

Xero allows businesses to create professional invoices within minutes. Users can customize invoice templates, add payment terms, enable online payments, and track when clients open or pay an invoice. Automated reminders help reduce overdue payments, improving overall cash flow.

2. Real-Time Bank Reconciliation

Bank reconciliation is one of Xero’s strongest features. The software automatically imports bank transactions and matches them with invoices or expenses. This reduces errors, saves hours of manual work, and ensures your books remain accurate and up to date.

3. Expense Tracking

With Xero, managing expenses becomes simple. Users can upload receipts, categorize spending, reimburse employees, and generate detailed reports. The mobile app allows you to capture receipts instantly, preventing lost documentation and improving compliance.

4. Inventory Management

Xero includes built-in inventory tracking that helps businesses monitor stock levels, track product performance, and calculate margins. This is especially useful for retail and e-commerce businesses that rely on accurate inventory data.

5. Payroll Integration

Businesses can handle payroll directly within Xero or integrate it with payroll applications. The system calculates wages, taxes, and deductions automatically. Employees can also access digital payslips, reducing administrative tasks for HR teams.

6. Financial Reporting

Xero generates real-time reports such as profit and loss, balance sheets, cash flow statements, and customized business dashboards. These reports help business owners understand their financial health and make more informed decisions.

7. Multi-Currency Support

For businesses working with global clients, Xero’s multi-currency feature updates exchange rates automatically and simplifies international transactions.

8. App Marketplace

Xero connects with over 1,000 third-party applications, including CRM systems, payment gateways, POS tools, and e-commerce platforms. This flexibility allows businesses to create a complete and customized financial system.

Benefits of Using Xero for Your Business

Improve Efficiency Through Automation

Xero automates repetitive financial tasks such as data entry, payment reminders, bank imports, and report generation. This allows business owners to save time and reduce the risk of human error.

Enhanced Collaboration With Accountants

Because Xero is cloud-based, accountants and bookkeepers can access your financial data anytime. This enables faster communication, easier problem-solving, and more accurate financial advice.

Better Cash Flow Control

With features like invoicing, online payments, and real-time dashboards, Xero helps businesses track income and expenses efficiently. You can understand financial trends early and take action before problems grow.

Secure Storage and Backup

Xero uses bank-grade security, encryption, and automatic backups to protect financial data. This ensures your business information is safe and always accessible.

Scalable for All Business Sizes

Whether you are a freelancer or a medium-sized company, Xero can scale as your business grows. You can upgrade plans or add integrations without disrupting your workflow.

Who Should Use Xero?

Xero is an excellent choice for:

-

Small businesses wanting an easy-to-use accounting system

-

Freelancers who need simple invoicing and expense tracking

-

E-commerce stores requiring real-time inventory and payment synchronization

-

Service-based businesses managing multiple projects or clients

-

Companies working internationally and dealing with different currencies

Because of its flexibility and large integration ecosystem, Xero fits almost any type of business model.

Why Xero Stands Out From Competitors

Compared to traditional accounting software, Xero is modern, intuitive, and built for cloud use. It offers real-time financial visibility, seamless automation, and an open integration system. Many users prefer Xero because it eliminates manual spreadsheets, reduces accounting mistakes, and gives business owners complete control over their finances.

In addition, the interface is clean and easy to navigate, making it ideal for beginners who are not familiar with accounting. Xero’s strong customer support and global community also make learning and troubleshooting easier.

Conclusion

Xero is more than just an accounting tool—it is a complete financial management system designed to help businesses operate efficiently and grow sustainably. With its automation features, real-time reporting, secure cloud technology, and wide range of integrations, Xero empowers business owners to take control of their financial future. Whether you are a small retailer, freelancer, or expanding company, Xero provides the tools and insights you need to manage your money with confidence.